Message from the President & Chairperson

As the end of another fantastic year at Illinois Mutual approaches, I find myself reflecting on how quickly this year has gone.

Through 2023 and into 2024, as always, Illinois Mutual is here to support you with tools, resources and representatives ready to provide what you need to help you finish the year strong. Our teams are always striving to provide the best service to you and your clients, both from a product offering perspective and from an overall sales perspective.

Our marketing materials outline the distinct advantages Illinois Mutual’s life, DI and worksite insurance offerings can bring to your product portfolio. For example, our new starting professionals program provides DI coverage for individuals who are near completion of apprenticeships, licensing or accreditation programs. Our Simplified Issue Whole Life (SIWL) product, with its simplified underwriting, can be easier to qualify for than many other types of life insurance. And our worksite product offerings continue to provide benefit solutions for small businesses at no direct cost to the employer.

Read on to learn more ways you can help your current clients and add new clients to your book of business. We are here to support you in any way we can as you help people achieve and safeguard their financial security. As the holiday season and New Year celebrations approach, don’t forget to give yourself the time to rest, reflect and recharge so you can start 2024 strong.

Katie M. Jenkins

President & Chairperson

Inside this Issue...

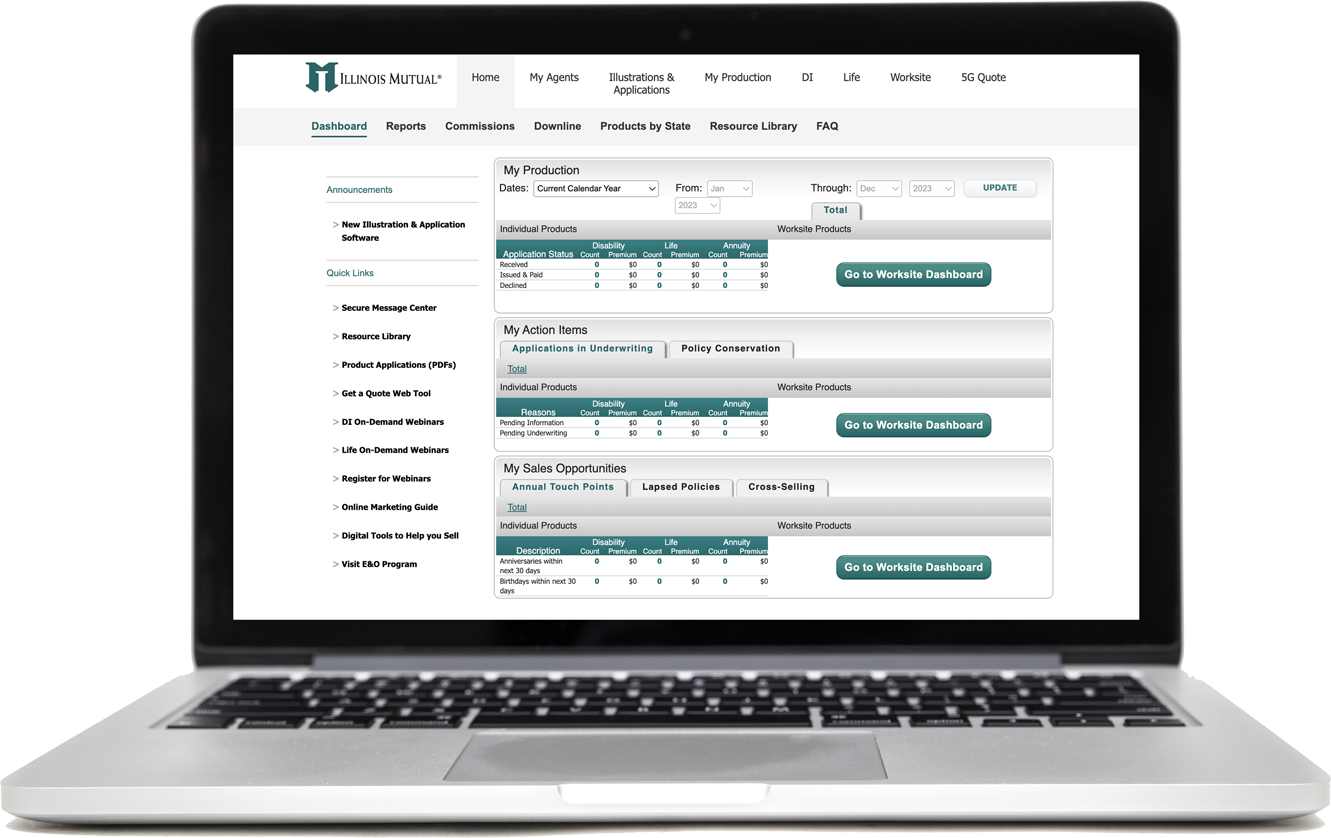

Agent Portal Advantages

From viewing commissions to submitting electronic applications, Illinois Mutual’s Agent Portal is your one-stop-shop for optimizing your business online.

The Agent Portal is your hub for ordering or downloading marketing materials, creating illustrations, accessing product applications or submitting electronic applications, viewing on-demand webinar training, generating leads from your own website with our Get a Quote web tool, and so much more!

The “My Action Items” section allows you to stay up-to-date on the status of your pending applications. If you need to reach out to the underwriter, simply click on the email address in the box near the bottom of the screen.

Find the Marketing Materials You Want on Our Resource Library!

To review our free marketing materials and other resources, click on the “Resource Library” link located near the top left of the Agent Portal homepage.

The Resource Library allows you to access Illinois Mutual’s marketing materials, product guides, required application forms, and more. We encourage our agents to contact our sales team to talk through what sales concepts may be right for your situation.

Let’s do more business together!

Why sell worksite voluntary benefits from Illinois Mutual?

- Electronic Funds Transfer (EFT) payment options for groups where payroll deduction could be challenging.

- Niche guaranteed issue options for small groups of 3 to 250+.

- Census enrollment for group DI makes for fast, easy enrollments.

Why sell life insurance from Illinois Mutual?

- Seven different level term periods available, including To Age 65 and To Age 70.

- Continuous Pay, Limited Pay and Single Pay Whole Life options.

- Simplified Issue Whole Life (SIWL) Final Expense coverage available for ages 45 to 85 and from $5,000 to $50,000.

Why sell DI from Illinois Mutual?

- Our Return of Premium (ROP) Rider* offers your clients income protection if needed, cash back if not.

- Our wide range of eligible occupations, including starting professionals, means more prospects.

- Our team of experts will help you add DI to your life, health and P&C sales.

Contact your sales team today to get started!

(800) 437-7355, Option 2

[email protected] | [email protected]

*Available at an additional cost. The Return of Premium Rider returns 100% of premiums paid, less any benefits received, when the insured reaches ages 65 to 67. Beginning with the fifth policy year, the policyowner is eligible to receive a portion of the premiums paid, less any benefits received. The policy ends after the return of premium is paid and may not be reinstated.

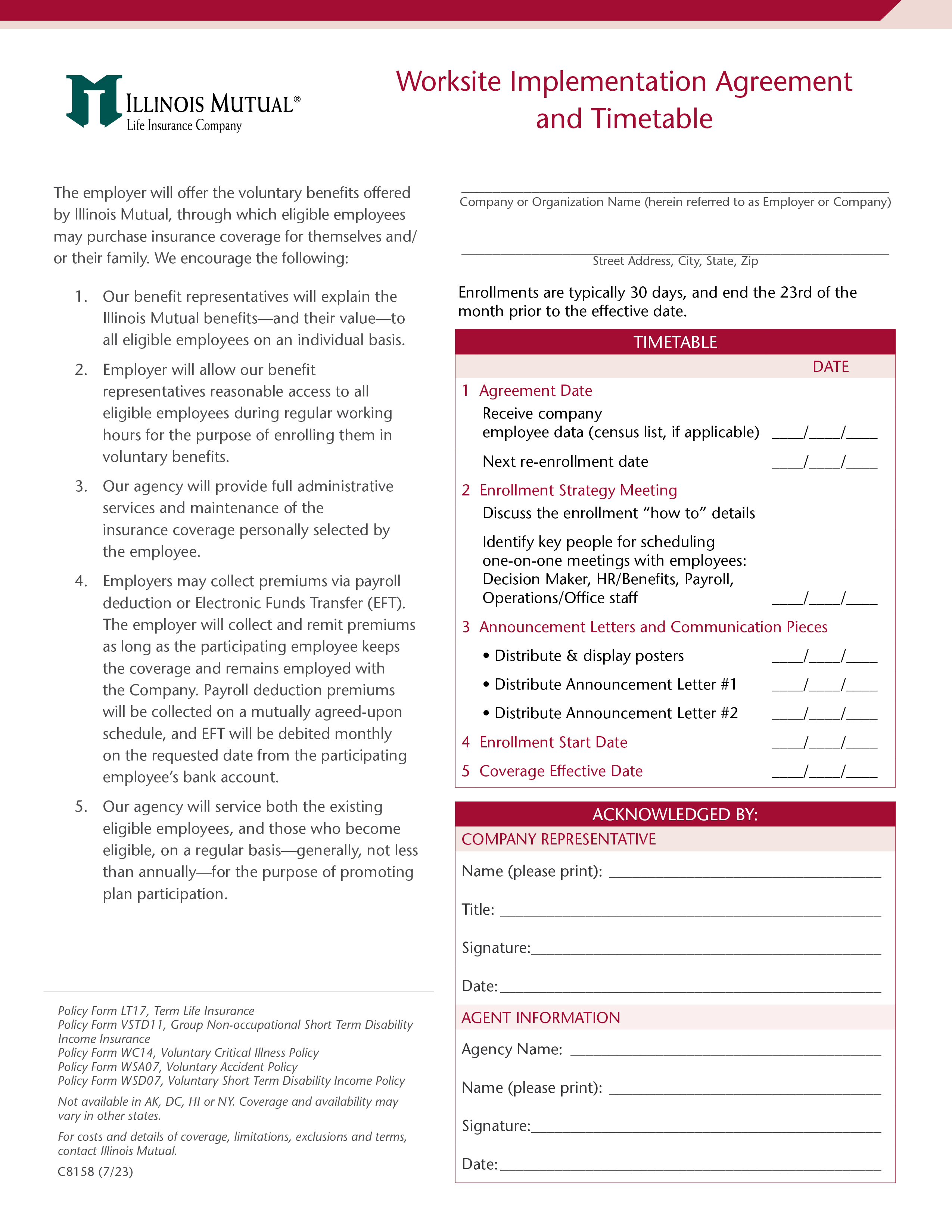

Enrollment Next Steps Made Easy

New Employer Agreement & Timetable

After you secure a worksite sale – what’s next?

Our new fillable Employer Agreement & Timetable flyer is designed to help agents and employers brainstorm the next steps of the enrollment offering, including:

Identifying key people to meet with.

Securing the enrollment start date.

Distributing communication pieces to employees regarding their upcoming enrollment.

Understanding coverage effective dates.

Why is this important?

Creating a solid plan gives both the agent and the HR rep confidence and trust in the newly-built relationship. Plus, you won’t have to wonder how or when you’re going to talk with the employees of the group—you’ll already have a plan in place!

Log in to the Agent Portal at Agent.IllinoisMutual.com and visit our Resource Library to download this new Employer Agreement piece today!

C8158

Employer Agreement & Timetable Fillable Flyer

Your Worksite sales team can give you more sales tips!

(800) 437-7355, Option 2

[email protected]

New Starting Professionals Program

Illinois Mutual now offers disability income insurance (DI) coverage to individuals who are beginning their careers in certain occupations.

Who is Eligible?

Individuals who may be eligible for coverage would be near completion of apprenticeships, licensing or accredited certification programs.

Why DI?

New professionals entering the workforce should consider the following questions when considering DI:

How long could you go without a paycheck?

As you enter your career, have you taken steps to protect your income if you become disabled and unable to work for a time?

Example occupations now eligible for DI coverage prior to securing employment include:

- Carpenters

- Cosmetologists

- Dental Hygienists

- Electricians

- Registered Nurses

A9746

DI Coverage for Starting Professionals

Log in to the Agent Portal at Agent.IllinoisMutual.com and visit our Resource Library to see a list of these eligible occupations!

To learn more about the program, contact your DI sales team today!

(800) 437-7355, Option 2

[email protected]

Simplified Issue Whole Life: Coverage for Final Expenses!

Many families experience financial problems with unexpected expenses after the death of a loved one—such as funeral costs, medical bills or other outstanding debts.

With Simplified Issue Whole Life (SIWL) from Illinois Mutual, your clients can easily apply for a simple and effective plan that can provide a death benefit to help beneficiaries pay for:

Funeral Costs

Medical Bills

Probate Expenses

Outstanding Debts

SIWL policy benefits may also be used to help:

Support a grandchild’s college education.

Provide income to surviving loved ones.

Arrange for a charitable gift.

Create an endowment fund for a church or non-profit organization.

We have created marketing materials to help you explain the need and the solution to your clients, and these pieces are available in Spanish as well*!

A5862

SIWL Agent Product Guide

C5864

SIWL Consumer Guide

STF159

SIWL Stuffer

A5868

SIWL Monthly EFT Rate Guide

Log in to the Agent Portal at Agent.IllinoisMutual.com and visit our Resource Library to download and order a complimentary supply today!

Contact your Life sales team for more information!

Updates from Underwriting

Improvements to the Life Issue Process

Illinois Mutual is excited to announce recent improvements to the Life Issue process, resulting in improved service time from case approval to policy issue.

This new process allows data to automatically populate from our underwriting system into the policy administration system. This means once an application is approved by the underwriter, the majority of the data is automatically transferred.

Benefits For Our Agents

Reduces processing time for policy issue!

Faster commission payments!

Updated NUA Emails

You may have noticed some changes in the way you receive your notice of underwriting action (NUA) emails. This is intended to help keep your clients’ information safer by decreasing the amount of personal information we send via email.

Feel free to contact Illinois Mutual Life Underwriting to learn more about our new underwriting system and how we can be of service:

(800) 437-7355, ext. 810

[email protected]

Mutual Updates

Life/DI |

|

|

December 8, 2023 |

Last day to receive an ‘in good order’ application to be completed for year end. If information is missing, adverse information is disclosed/discovered or requirements are pending due to age, amount or for cause, the case cannot be guaranteed for year end. |

|

December 15, 2023 |

All final, pre-issue underwriting requirements must be received. |

|

December 22, 2023 |

All post-issue underwriting requirements must be received and completed in full, including premium, illustrations, amendments, etc. |

|

December 29, 2023 |

Last day business can be placed in force for 2023. |

Worksite |

|

|

December 18, 2023 |

All ‘in good order’ applications received by 12/18/2023 will be given a 1/1/2024 effective date and will be guaranteed to be on the group’s invoice. We cannot guarantee that any applications received after this date for a 1/1/2024 effective date will appear on the group’s invoice. We will guarantee this business will be issued by 12/29/2023. |

|

December 21, 2023 |

For the business to appear on the January invoice for the group, all pending requirements must be received by 12/21/2023. We will guarantee this business will be issued by 12/29/2023. |

|

December 30, 2023 |

Last day business can be placed in force for 2023. |

Due to the banking holidays on 11/23/2023 and 1/1/2024, any 11/22/2023 and 12/29/2023 commissions will be delayed a day.

New Phone System Options

Main Phone Number: (800) 437-7355

Option 1: Dial by Extension

Option 2: Sales

Option 3: Policy Service

Option 4: Claims

Option 5: Underwriting

Option 6: Agent Contracting & Commissions

Option 7: Consumers Requesting to Talk to an Agent

If you call after hours, you may hear a voicemail message which will direct you to provide information in order for us to best help you when we receive your message.

Quarterly Incentives Available

Ask your sales team how you can qualify for an extra bonus with quarterly incentives for selling Life, DI and Worksite!

(800) 437-7355, Option 2

[email protected] | [email protected]

Advantages of Submitting Electronic Applications (eApps):

The faster you write an app, the faster our underwriters can get back to you with a decision.

Promotes ‘in good order’ apps – less back-and-forth compared to paper.

Watch these overview videos for submitting life and DI applications electronically!

www.IllinoisMutual.com/eApps